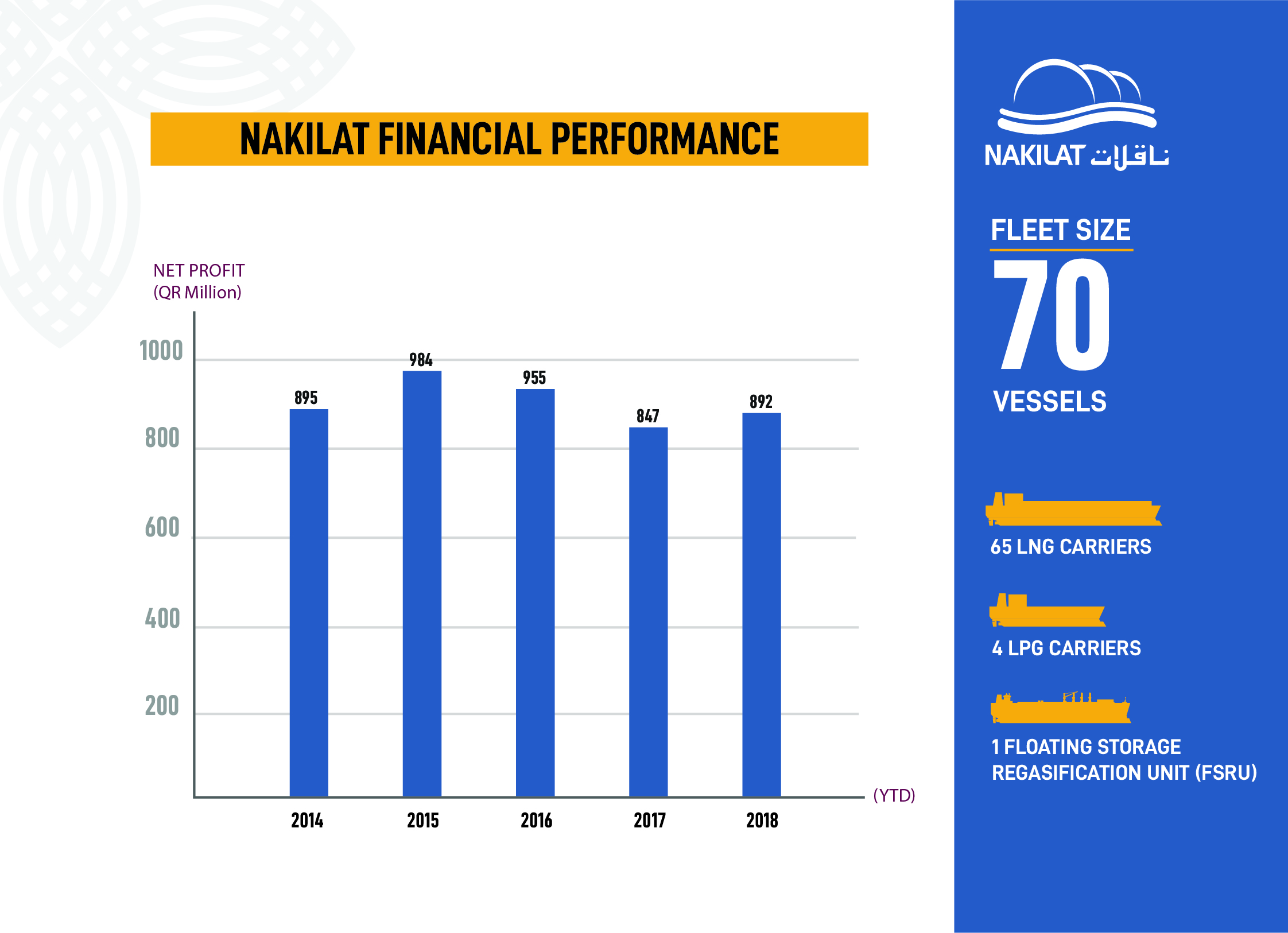

Nakilat’s earnings increased by 5.3% to QAR 892 million profit for the year 2018

17 February 2019

Nakilat today reported financial results for the year ended 31 December 2018, with a net profit of QR 892 million in 2018 (or QAR1.61 per share), an increase of 5.3%. Excluding the 2017 one-off item (available for sale investments), the 2018 net profit increased by 14%. The Board of Directors of Nakilat is pleased to recommend a cash dividend at QAR 1.00 per share and to invite shareholders to the annual general assembly taking place on Tuesday, 19th March 2019.

The key drivers of the company’s stronger financial performance were the successful implementation of its strategic long-term plans to diversify and seek new business opportunities with measured balanced risk. In addition, the company achieved positive results across its operations that exceeded planned expectations in 2018 through enhanced operational efficiency and cost effectiveness, which further solidifies Nakilat’s position as a global leader in energy transportation and maritime services.

During the year, Nakilat expanded its fleet with the addition of two liquefied natural gas (LNG) carriers and acquired a major stake in its first floating storage regasification unit (FSRU). This opened a new horizon and business avenue for the company to grow its international outreach, which in turn will further maximize value and returns for its shareholders. The company’s effective expansions successfully contributed to enhancing operational excellence and are well reflected in its outstanding financial results.

Nakilat’s Board of Directors commended the company’s solid financial results and operational performance, which bears testament to its resilience and prudent strategic efforts towards maintaining its leadership in the global energy transportation market, as well as supporting Qatar’s ambition to be the top exporter of LNG. Complemented by strategic long-term agreements with well-established charterers and its own determination to operate sustainably, Nakilat has managed to maintain steady cashflow and generate positive value for its shareholders.

The Board also noted the company’s continued excellence in health, safety and environmental management, with a higher benchmarked average safety record compared to other companies operating in the same industry. Nakilat’s commitment to cybersecurity compliance was also highlighted as the company takes necessary measures to ensure the reliability of its operations and business continuity.

In line with Nakilat’s compliance of the Qatar Financial Market Authority (QFMA) Investor Relations guidelines as well as part of its strategy to engage shareholders and investors, Nakilat will be holding a conference call to discuss its financial results on Tuesday, 19th February 2019.

The Board of Directors would like to express their gratitude to Qatar Petroleum as well as Qatargas, the main charterer of Nakilat’s fleet, for their continued support and significant role in contributing towards the achievement of the company’s strong financial results.