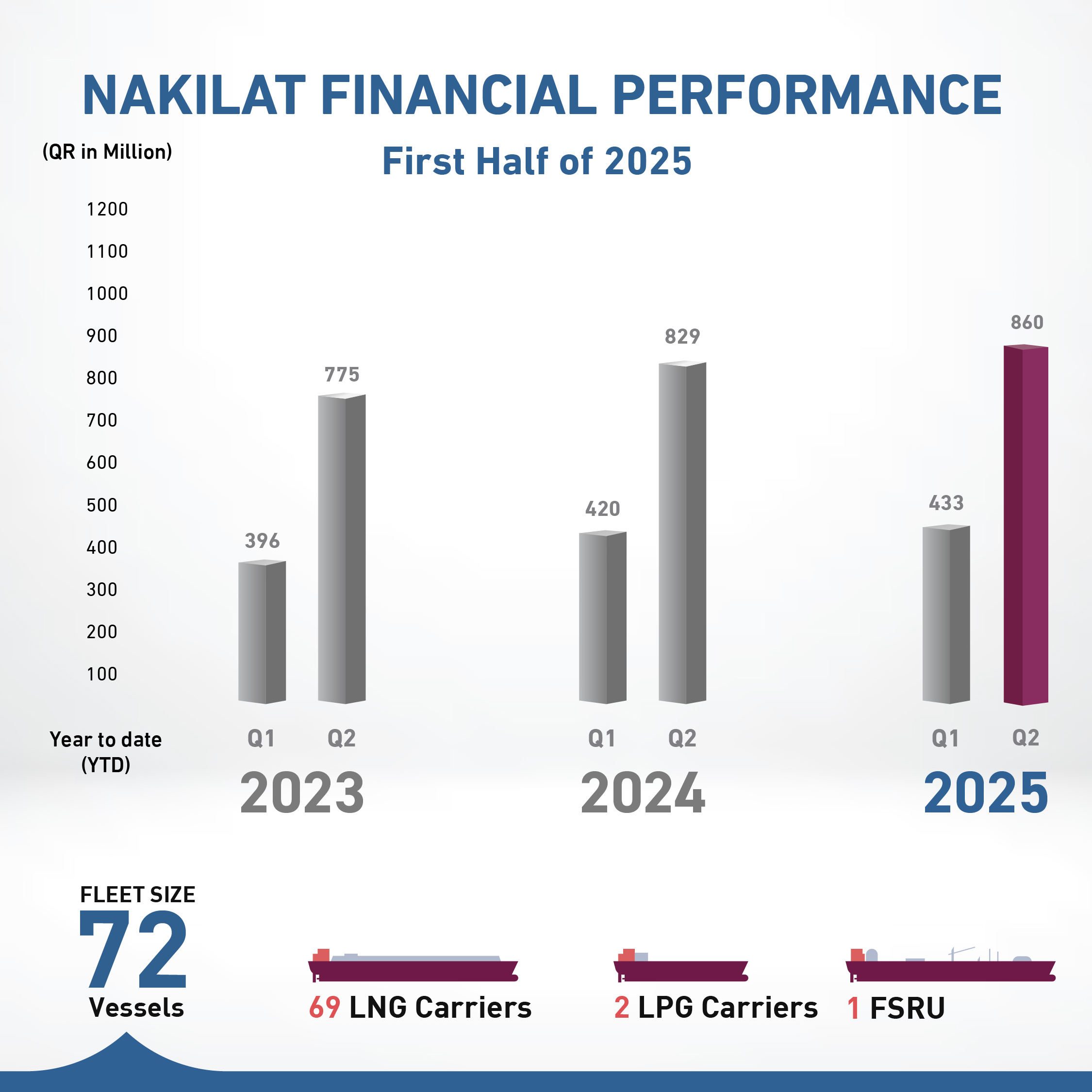

Nakilat achieves QAR 860 million net profit for the first half of 2025, an increase of 3.7%

Doha, Qatar – 29 July 2025: Qatar Gas Transport Company Q.P.S.C. (Nakilat) announced its consolidated financial results for the first half of the year ended 30 June 2025, with a net profit of QAR 860 million compared to QAR 829 million for the corresponding period in 2024, an increase of 3.7%. This continued strong financial performance underlines Nakilat’s operational resilience and strategic discipline.

In addition, the Board of Directors approved an interim cash dividend for the first half of the year 2025 ended June 30, 2025, of 7.2 Qatari Dirhams per share. The interim dividend entitlement for the first half of the year 2025 will be granted to shareholders who own shares at the end of the trading session on August 6th, 2025. These dividends will be distributed in line with the directives of the Qatar Financial Market Authority through Edaa.

Key financial highlights for the first half of 2025:

- Achieved a net profit of QAR 860 million, up 3.7% year-on-year.

- Incurred total expenses of QAR 1,396 million, reflecting a decrease of 4.5%.

Eng. Abdullah Al-Sulaiti, Nakilat’s Chief Executive Officer, commented: “Nakilat’s strong performance in the first half of 2025 reflects the dedication of our team and the flexibility we adopt in maintaining and sustaining our operations. We remain committed to deliver value to our shareholders, partners, and the global energy market through safe, efficient, and sustainable transportation of LNG. Nakilat remains focused on long-term growth and supporting the evolving global market and business environment.

Beyond maintaining resilient vessel operations, we are actively pursuing an innovative financing strategy to further strengthen Nakilat’s financial position. This includes exploring creative structures and cost-effective solutions to reduce overall funding costs. These initiatives enhance our financial flexibility and resilience, positioning us to deliver greater long-term value. By reinforcing the stability of our cash flows, we reaffirm our commitment to generating sustainable, growing returns for our shareholders, a commitment clearly reflected in our latest financial results.”

In 2025, Nakilat made substantial progress across its operations and strategic growth initiatives. The Company celebrated yet another significant milestone with the steel cutting ceremony marking the commencement of construction of 25 LNG vessels at various shipyards in South Korea. The vessels are part of QatarEnergy’s historic LNG fleet expansion project, which caters for future LNG fleet requirements for its LNG expansion projects. Owned by Nakilat, and built with a capacity of 174,000 cubic meters, the new vessels will be chartered to QatarEnergy affiliates under long-term agreements.

The Company has also commenced the construction of 6 new vessels at the Hyundai Samho Heavy Industries shipyard in South Korea, including 2 LNG vessels and 4 LPG/ammonia vessels. These vessels will be fully owned by Nakilat.

Nakilat maintained its five-star rating from the British Safety Council in the Occupational Health and Safety Audit for the eighth consecutive time, and in the Environmental Sustainability Audit for the third consecutive time, reflecting its unwavering focus on safety, excellence, and sustainability. The Company was once again recognized among the Top 100 Listed Companies in the Middle East for 2025, reaffirming its leadership in the region’s maritime and energy logistics sector.

In keeping with its commitment to exemplary investor relations, Nakilat will host a conference call to discuss the financial results for the first half of 2025 on Wednesday, July 30th, 2025, at 13:30 hours (Doha Time). The presentation will be published on the company’s website prior to the conference call. For dial-in details and additional information, please visit the company’s website at www.nakilat.com.